The goal of financial planning is to build enough assets, by the time you retire, that the income earned from investments (including pensions etc.) will provide you with your desired lifestyle, without the need to get out of bed and go to work.

Simple, right? All other discussions relate to the strategies you can use to build your wealth to the point of Financial Independence or beyond. For true wealth, think about acquiring capital or assets beyond supporting your standard of living.

Amongst new investors just starting to build their investment assets, the focus is often on returns, ROI, fees and so on. But does this really matter? To what extent are savings impacted by the amounts saved? When do investment returns matter more than the rate of savings, (as a percentage of gross income) or the amount saved over time as your income changes?

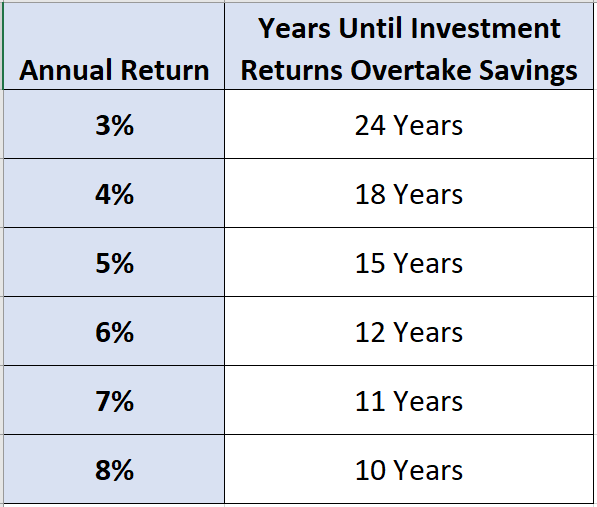

Returns always matter - but in the early years, savings matter more. The only question is, what is the likely crossover point when returns matter more than savings. One rule of thumb is that returns matter more than savings when your assets or investments are greater than 2-3 times your annual income. So, lets take a look at the math.

Suppose you invest $10,000 per year for 20 years at an assumed net return of 5% compounded. In Year One, you will have $10,500 where 95% of your net worth comes from savings and only 5% from investment returns. In Year 10 it is 61% versus 39% from investment returns and so on (you can check this with a spreadsheet or calculator but don’t get too hung up on the specifics, it is the principal that is important). It will take until around Year 15 before investment returns overtake savings as a contributor to increased net worth, or investment amounts.

The following table shows you how different rates of return affect the time needed for investment returns to surpass savings as the main contributor to growing your financial net worth.

This table1 assumes you consistently save the same amount each year.

This principle remains the same no matter how much you invest, whether it is $5,000, $10,000, $20,000 or more. For this analysis, we assumed you invested the same amount annually. It is likely that as you get older, your yearly income and\or personal expenses and obligations (daycare, mortgages, children get older etc.) will change and you will be able to save more each year in dollar terms.

A friend recently mentioned how he invested in an alternative popular currency about three years ago. It is often touted as a replacement to the dollar as a reserve currency (The regulators will not allow me to name this alternative currency specifically so you will have to use your imagination) and made 30 times his money. Fantastic except he then said he only invested $40. While the returns are impressive in percentage returns, it makes little difference to his net worth.

Keep some basic investment rules of thumb in mind as you continue your journey to building wealth and financial independence:

- Time invested matters. The power of compounding makes a dramatic difference to capital values after the seventh doubling. One becomes two, then 4, 8, 16, 32, 64, 128…

- Savings rates matter as a percentage of income.

- Amount invested, or position size is important.

- Diversification matters.

- Risk management smooths out your investment ride and allow you to emotionally stay in the investments over time to capture the upside.

- Patience is a virtue – Rome was not built in a day!

Many financial strategies indicate a need to accumulate $1 million dollars to achieve the average Canadian’s desired retirement income of $50,000. Thankfully, the power of compounding and investment returns will do much of the heavy lifting once you reach a certain point - something around $300,000 - $400,000 depending upon assumed rate of return and your age. Do market returns and corrections really matter if you do not have enough capital?

Call our office today to learn how we can help you build and grow your investment capital as well as preserve it in your retirement years.

1 Table produced by Wealthworks Financial

Copyright © 2021 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is based on the perspectives and opinions of the owners and writers only. The information provided is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of the AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.